How an integrated advisory approach turned stress into strategy.

The Challenge: Finding proactive, connected advice

Safety Management Solutions, founded in 2014, is a specialist consulting firm delivering workplace safety and compliance services nationwide. By 2018, the business was performing well, but turnover was uneven and the directors were at a crossroads — unsure whether to pursue further growth or simplify the business.

They were also looking for support beyond compliance, including improving bookkeeping efficiency and making informed personal investment decisions such as purchasing a rental property. What they wanted most was a proactive, solutions-focused adviser who could bring clarity, structure and strategic insight — something they weren’t getting from their existing accountant.

I remember feeling stressed and concerned about what we would do, given that the tax year had just finished. Then I was referred to Melissa Healy at DFK Everalls. During that first call, she simply said: ‘Would you like us to take care of your tax?’ I immediately felt a sense of relief. It was a breath of fresh air to have someone take that worry away from me.

Fiona Hickinbotham - Operations Manager - Safety Management Solutions

The Everalls Approach: Unlocking financial potential through clarity and structure

When Safety Management Solutions first came to us, our goal was clear — to help them unlock their financial potential by rebuilding strong foundations for growth. Their previous systems weren’t giving them the visibility or confidence they needed, so we took a holistic approach to connect every part of their financial picture.

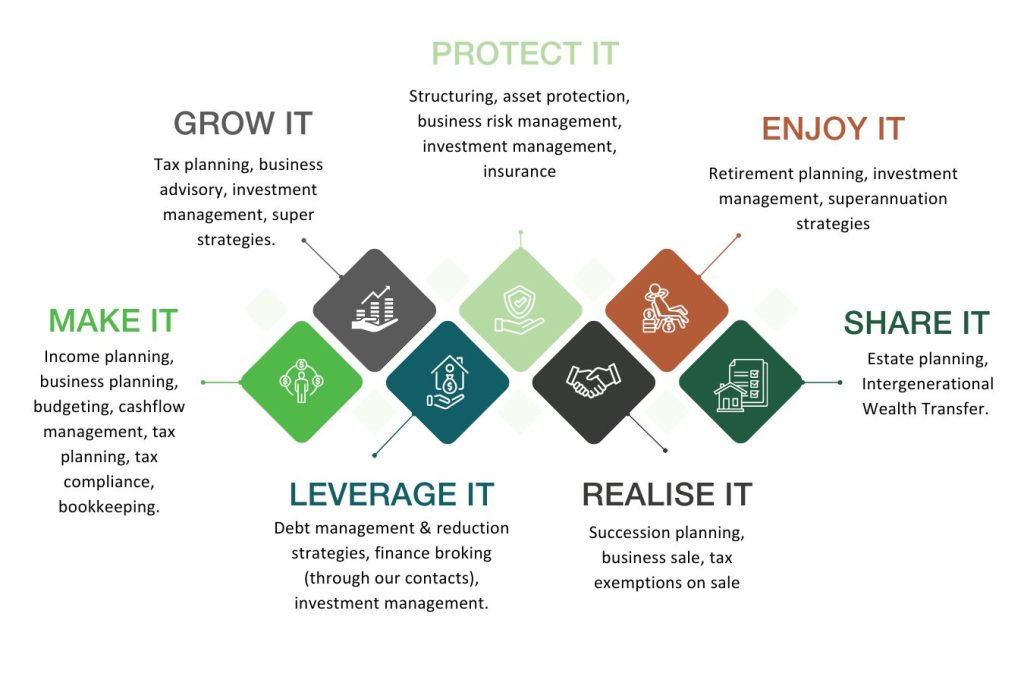

For Safety Management Solutions, our work centred on four key areas of our broader “Unlocking Financial Potential” framework — Make it, Grow it, Protect it, and Enjoy it. These pillars guided how we helped transform their business and financial confidence.

Make it – Start strong

We began by reviewing their business and personal financial structures to ensure they were tax-effective, compliant, and flexible for future growth. We streamlined their bookkeeping processes to improve accuracy, visibility and cashflow control.

Grow it – Build momentum

With stronger systems in place, we worked with the directors to align business performance with their personal financial goals. We facilitated a Strategic Planning Day to develop a strategic plan to grow the business focussing on client services, team development, improvements to systems & processes, and ultimately profit improvement — creating a roadmap for sustainable success.

Leverage it – Manage debt

We were able to provide advice to manage their debt better and to ensure it was paid off faster.

Protect it – Safeguard what matters

We helped put in place strategies to strengthen the business and reduce risk. This gave the owners confidence that their hard work was secure and their business could grow without unnecessary exposure.

The change process was seamless. For the first time, we could see how the business, personal finances, and future goals all connected.

Fiona Hickinbotham - Operations Manager

Enjoy it – Connect business and life goals

As the business matured, the next step was to ensure the owners’ personal wealth strategy matched their business success. That’s when we introduced Everalls Wealth Management (EWM) to help them plan for the future. The EWM team talked to them about their personal financial goals and developed a comprehensive, tailored plan to achieve them, seamlessly linking business, tax, and personal financial goals. This included:

- Cashflow and savings optimisation to improve personal liquidity and security.

- Personal debt reduction strategies;

- A review of superannuation underlying investments and contribution strategies to ensure growth of their retirement savings;

- A review of personal insurance policies to ensure appropriate cover to safeguard their family’s financial well-being and reduce premiums.

- Long-term retirement and wealth-transfer planning for future peace of mind.

There are so many areas of life that cause stress, particularly when you’re running a small business. It’s a relief to have complete confidence that one of the most important areas of our lives is being handled so well by DFK Everalls.

Fiona Hickinbotham - Safety Management Solutions

We’d been so impressed with how our business and personal taxation was being managed that we wanted DFK to look after our financial advice too. The joined-up approach made everything simpler and more effective.

Fiona Hickinbotham - Operations Manager

Broadening the Partnership: Connecting business and personal wealth

When the team at Safety Management Solutions experienced the impact of an integrated accounting and advisory approach, they wanted that same clarity across their personal finances.

In 2021, we welcomed them into Everalls Wealth Management, where our Director Bob Chen developed a tailored wealth strategy designed to build and protect their personal prosperity.

Working closely with our accounting and advisory teams, EWM provided:

- Superannuation and investment strategies aligned with their business goals.

- Cashflow and savings optimisation to improve personal liquidity and security.

- Insurance and risk reviews to safeguard their family’s financial wellbeing.

- Long-term retirement and wealth-transfer planning for future peace of mind.

By connecting all areas of advice — business, tax, and wealth — we helped the directors make smarter, more confident decisions. They now have one cohesive plan that aligns their business success with the lifestyle and legacy they want to create.

The Results: Confidence, growth and alignment

For the business

Safety Management Solutions now operates with a clear financial framework, accurate forecasting, and a consistent advisory rhythm. Their structure is more efficient, their tax outcomes optimised, and their business decisions supported by expert insight.

The directors have more time to focus on clients and growth, knowing that their financial affairs are in trusted hands.

For the individuals

Through Everalls Wealth Management, the owners have achieved several long-term personal financial goals earlier than expected — a direct result of the integrated, strategic approach.

A Trusted Partnership for the Long Term

The relationship between Safety Management Solutions and DFK Everalls has evolved from a reactive tax engagement into a proactive, strategic partnership that delivers clarity, structure, and peace of mind across every aspect of their financial life.

Today, with both DFK Everalls and Everalls Wealth Management working in unison, Safety Management Solutions can look to the future with confidence — supported by a team that truly understands how business and personal wealth intersect.

From our initial contact with Melissa to the ongoing support and guidance received from the team, we’ve found them all to be professional, knowledgeable and understanding of our requirements. No question has been too difficult to answer, and the responses have been invaluable to our continued business success.

Fiona Hickinbotham - Safety Management Solutions